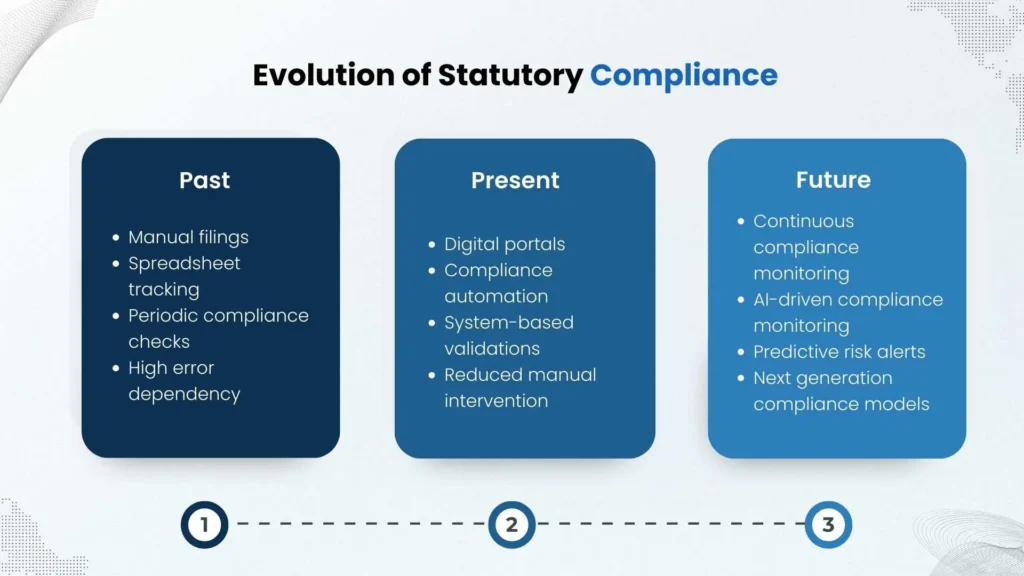

The future of statutory compliance is no longer about simply meeting deadlines or submitting forms on time. It is evolving into a continuous, technology-enabled discipline that directly impacts payroll accuracy, employee trust, and organizational risk exposure. As labour laws grow more dynamic and regulatory scrutiny increases, businesses are actively rethinking how compliance is managed across payroll and workforce operations.

Search behaviour shows that organizations are no longer asking what statutory compliance is, but how it will change and how they can prepare. The answers lie in automation, intelligence, and a shift toward proactive governance.

Why Statutory Compliance Is Entering a New Phase

Compliance expectations have expanded significantly. Regulators now demand accuracy, traceability, and real-time accountability, pushing organizations away from fragmented processes toward structured compliance services.

Key factors reshaping regulatory compliance include:

- Frequent amendments in labour and payroll regulations

- Digitization of statutory filing and enforcement systems

- Higher penalties and tighter inspection mechanisms

- Increased focus on audit-ready documentation

As a result, compliance is no longer a periodic task but an ongoing operational responsibility.

Payroll as the Backbone of Future Compliance

Payroll is where statutory obligations converge. Errors in payroll processing directly affect tax deductions, social security contributions, and statutory filings, making Payroll compliance a central pillar of future-ready organizations.

Future-focused payroll compliance depends on:

- Law-aligned salary structuring and statutory deductions

- Accurate calculation of employee benefits and contributions

- Integration between payroll systems and compliance workflows

- Consistent, audit-ready payroll records

This shift positions payroll as a compliance control mechanism rather than a transactional function.

Labour Law Evolution and Employment Compliance

Labour laws are evolving to reflect modern workforce realities such as hybrid work, contractual employment, and distributed teams. These changes are redefining employment law compliance expectations for employers.

Organizations must now ensure correct worker classification, adherence to wage and hour regulations, and proper documentation of employment terms. Future compliance models rely less on post-event corrections and more on built-in controls that prevent violations at the source.

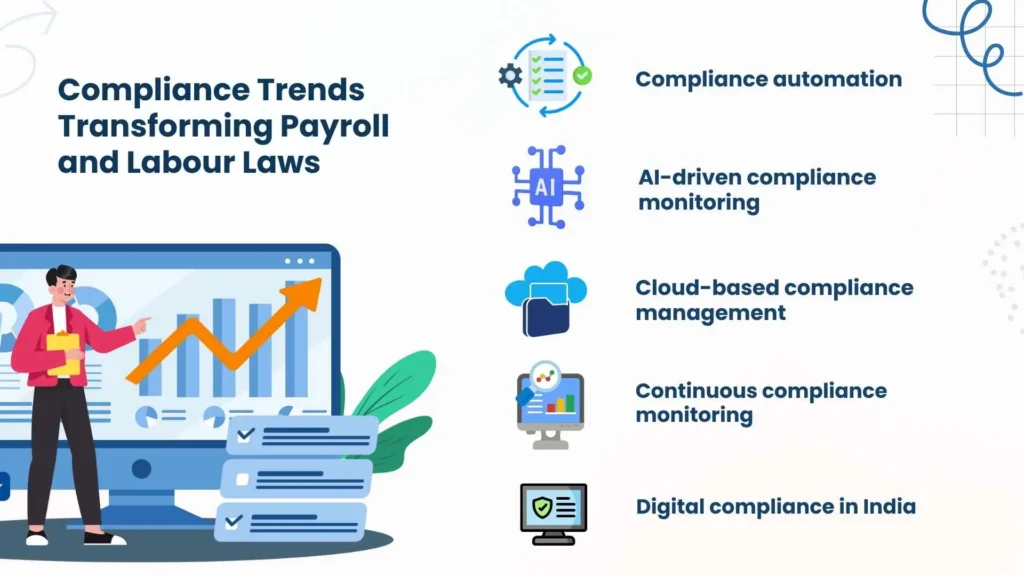

Compliance Automation Becomes the Default

As compliance requirements increase in volume and complexity, compliance automation is becoming essential rather than optional. Automation enables organizations to maintain accuracy and consistency without increasing administrative burden.

Modern compliance automation helps organizations:

- Validate payroll and statutory data before processing

- Automatically adapt to regulatory changes

- Trigger alerts for deadlines and discrepancies

- Reduce dependency on manual tracking and spreadsheets

This shift significantly reduces errors while supporting business scalability.

Shift Toward Continuous Compliance Monitoring

One of the most impactful trends shaping the future is continuous compliance monitoring. Instead of reviewing compliance status monthly or annually, organizations are moving toward real-time oversight.

With continuous monitoring, businesses gain:

- Early identification of payroll and filing discrepancies

- Reduced last-minute compliance corrections

- Stronger audit preparedness at any time

- Improved compliance risk management visibility

This approach transforms compliance from reactive correction to proactive assurance.

AI-Driven Compliance Monitoring and Predictive Oversight

Artificial intelligence is rapidly changing how organizations manage compliance risks. AI-driven compliance monitoring systems analyze payroll and statutory data to identify anomalies, detect patterns, and predict potential violations.

In payroll and labour law compliance, AI enables organizations to flag inconsistencies in deductions, benefits eligibility, and filing timelines before issues escalate. This supports next generation compliance, where risk prevention replaces post-violation response.

Cloud-Based Compliance Management as the New Standard

As organizations expand across regions and adopt remote work, centralized compliance systems are essential. Cloud-based compliance management platforms provide a unified view of payroll, labour law obligations, and statutory filings.

Cloud adoption offers:

- Centralized compliance data across locations

- Secure access for HR, finance, and compliance teams

- Scalability as the workforce grows

- Seamless integration with payroll systems

This shift supports faster decision-making and better governance.

Automated Statutory Filings and Digital Compliance in India

Government-led digitization initiatives are accelerating the adoption of automated statutory filings. Compliance portals are increasingly integrated with payroll systems, reducing manual intervention and errors.

This evolution is strengthening digital compliance in India by enabling faster filings, improved accuracy, and transparent audit trails. Digital compliance frameworks also improve accountability for both employers and regulators.

The Changing Landscape of PF and ESIC Compliance

Social security compliance continues to be a critical focus area. The future of PF ESIC compliance is shaped by tighter integration between payroll data and statutory systems, along with increased employee awareness.

Organizations must now ensure:

- Accurate contribution calculations across salary components

- Timely reconciliation between payroll and filings

- Proper eligibility tracking for different employee categories

- Expert oversight from a PF & ESIC Consultant

Strong PF and ESIC compliance not only reduces risk but also reinforces employee confidence.

Compliance Services Shift from Support to Strategy

Compliance is no longer viewed as a purely administrative function. Advanced compliance services are now aligned with strategic objectives such as workforce planning, expansion, and cost control.

Modern compliance support helps organizations:

- Anticipate regulatory changes

- Design compliant payroll structures

- Reduce long-term compliance risks

- Support scalable business growth

This strategic shift positions compliance as a business enabler.

Importance of PAN-India Compliance Frameworks

For organizations operating across multiple states, managing region-specific labour laws can be complex. A centralized approach supported by a PAN India compliance agency ensures consistency while addressing local statutory requirements.

PAN-India compliance frameworks simplify monitoring, reporting, and governance, especially for organizations with distributed teams or rapid expansion plans.

Managing Compliance Risk in a Dynamic Environment

The future of compliance places strong emphasis on structured compliance risk management. Instead of reacting to violations, organizations are identifying high-risk areas early and implementing preventive controls. Risk-based compliance models help businesses prioritize resources, align payroll processes with statutory requirements, and remain resilient amid frequent regulatory changes.

FAQ’s

Statutory compliance is becoming complex due to frequent regulatory changes, digital filing requirements, multi-state operations, and stricter enforcement of labour and payroll laws.

Compliance automation helps businesses reduce manual errors, track regulatory changes, automate calculations, and ensure timely filings, making compliance more accurate and scalable.

AI-driven compliance monitoring analyzes payroll and statutory data to identify patterns, flag anomalies, predict non-compliance risks, and support proactive decision-making.

Digital compliance in India refers to the use of online government portals, automated filings, and digital records for managing statutory obligations such as PF, ESIC, and tax compliance.

A PAN india compliance agency helps businesses manage statutory compliance across multiple states by ensuring consistency, handling regional regulations, and centralizing compliance reporting.

Businesses can prepare for next generation compliance by investing in compliance automation, cloud-based compliance management, expert compliance services, and strong compliance risk management frameworks.