India has long been a preferred market for global expansion, offering a vast talent pool, competitive labour costs, and a dynamic economy. Yet, beneath this opportunity lies a challenging compliance terrain.

In 2025, the compliance environment has become even more stringent as the Indian government continues to implement long-pending labour code reforms and strengthen digital governance. Businesses particularly foreign companies hiring in India must now navigate multiple state and central-level laws, manage digital tax filings, and ensure transparency across employment and payroll operations.

The rise of remote and hybrid models adds another layer of complexity to Hiring compliance India. Jurisdictional ambiguities, varying state-wise rules, and digital workforce models have expanded the scope of employer liability. In this context, compliance has moved from being a reactive HR activity to a board-level priority.

Evolving Legal Landscape (2025 Updates)

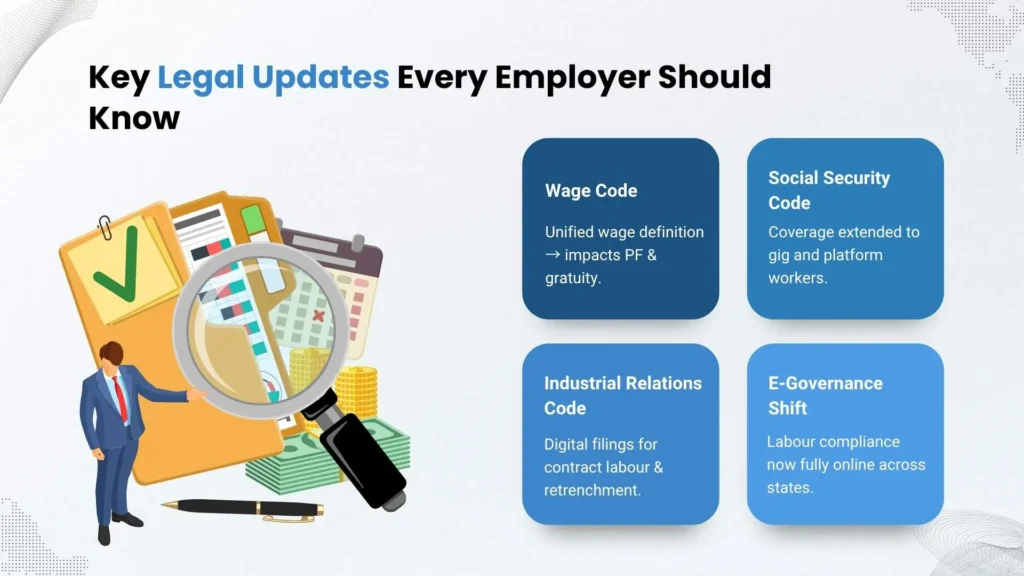

The year 2025 marks a critical phase in India’s transition toward unified labour governance. After years of deliberation, several components of the four new labour codes Wages, Industrial Relations, Social Security, and Occupational Safety, Health and Working Conditions have either been rolled out or are in advanced stages of enforcement.

Key 2025 Reforms Impacting Employers

- Wage Code Alignment: The new labour law updates standardize the definition of ‘wages’ across states, directly affecting take-home pay, PF contributions, and gratuity calculations. Employers now need to ensure transparent structuring of compensation packages in compliance with the updated wage definitions.

- Social Security for Gig and Platform Workers: With new 2025 updates, companies hiring gig or freelance workers must now meet social security obligations under the Social Security Code 2020.

- Industrial Relations Modernization: Revised rules around contract labour, retrenchment, and standing orders have altered industrial relations obligations. Businesses now face tighter reporting norms and digital filings under the Shram Suvidha portal.

- Digital Governance & E-Compliance: States like Maharashtra, Karnataka, and Telangana have fully transitioned to e-filing and real-time compliance dashboards. These changes require HR and finance leaders to integrate digital compliance systems to avoid penalties for delayed submissions.

The takeaway? The rapid pace of 2025 labour law updates makes compliance an ongoing digital process, not just a yearly audit task.

Financial Compliance Challenges

Financial compliance in India is intricately linked with employment laws. Organizations, especially foreign companies hiring in India, must comply with multiple tax, payroll, and reporting obligations under the Income Tax Act, PF Act, and Employees’ State Insurance Act.

1. Complex Payroll & Employee Taxation

Employee taxation India has evolved with increased reporting obligations and digitized scrutiny. Employers must manage monthly TDS, PF, ESI, and professional tax across states.

Key compliance areas include:

- Tax Deduction at Source (TDS): Companies must ensure timely deductions and filings under Section 192 for salaried employees, aligning with the new Annual Information Statement (AIS 2.0) framework.

- Provident Fund (PF) & ESI: Updated thresholds under labour law updates 2025 have changed PF and ESI coverage criteria, requiring careful payroll audits.

- Gratuity & Leave Encashment: Re-evaluating these liabilities has become essential for accurate balance sheet provisioning and compliance with the Wage Code.

2. Cross-Border Financial Compliance

For multinational organizations, compliance extends beyond payroll to encompass foreign exchange regulations and transfer pricing.

- RBI & FEMA Compliance: Outbound salary payments, equity compensation, and expatriate payroll must align with RBI guidelines and Foreign Exchange Management Act (FEMA) provisions.

- Transfer Pricing & Inter-Company Charges: Cross-border employee secondment or shared service models must be supported by appropriate inter-company agreements to avoid taxation disputes.

Failure to maintain documentation and transparent pricing structures can invite scrutiny from tax authorities, a growing concern highlighted in 2024–2025 corporate audits.

3. Common Pitfalls for Global Employers

- Overlooking dual taxation treaties and payroll localization for expatriate employees.

- Inconsistent classification of employees versus contractors.

- Ignoring local statutory compliance for employers on bonuses, overtime, and benefits.

In short, the financial compliance layer has become as critical as legal adherence. Non-alignment can trigger cascading penalties, audits, and even suspension of operations.

Multi-State and Remote Hiring Complexities

India’s federal structure means compliance obligations differ from state to state, a persistent challenge for companies operating across multiple jurisdictions.

1. Varying State-Level Regulations

Each state enforces its own Shops and Establishments Act, covering working hours, holidays, wage payment timelines, and employee welfare standards. For example, while Karnataka allows digital registers, Uttar Pradesh still requires physical muster rolls.

This disparity makes multi-state compliance in India one of the biggest challenges for growing organizations. Payroll teams must continuously update rule changes, especially around minimum wages and holiday notifications, which are revised every six months in many states.

2. Remote Work Jurisdiction Challenges

Post-pandemic, employees now work from smaller towns or tier-2 cities but employers often remain registered in metros. This geographic disconnect complicates jurisdictional compliance.

Who holds the liability if an employee working remotely from Rajasthan faces a labour dispute, while the company is registered in Mumbai? In such cases, courts often apply the jurisdiction of the place where work is performed adding uncertainty to Hiring compliance India.

Employers must now:

- Define clear remote-work clauses in employment contracts.

- Register under local Shops & Establishments Acts if hiring remotely across states.

- Ensure digital attendance and wage records comply with both central and state-level norms.

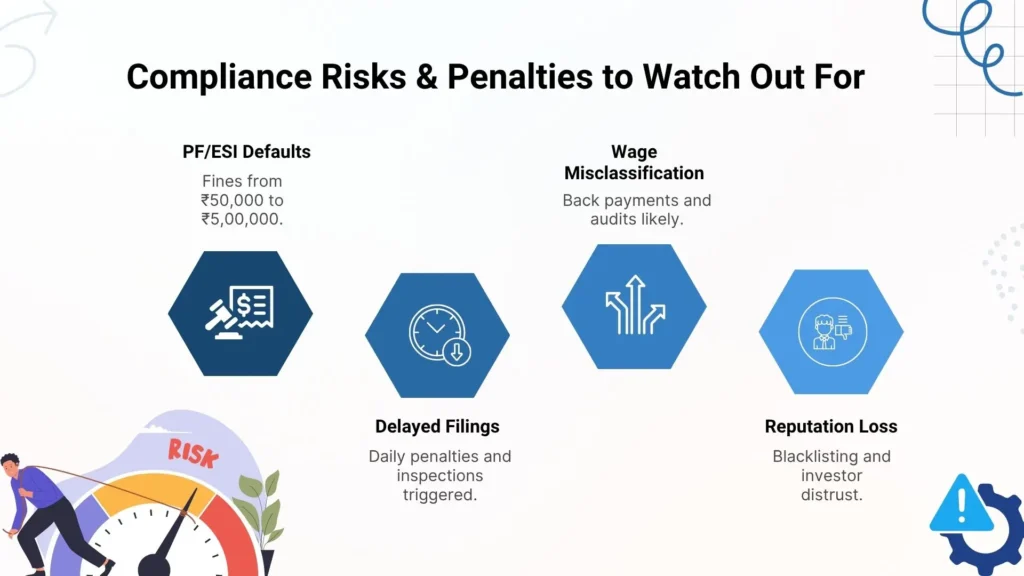

Key Risk Areas and Penalties for Non-Compliance

Increased digitization has enhanced the government’s enforcement capacity. The Ministry of Labour and state inspectorates now use AI-enabled tools to flag anomalies in PF and ESI submissions.

2024–2025 Enforcement Insights

- In 2024, the Employees’ Provident Fund Organisation (EPFO) issued over 3,000 notices to firms for wage misclassification under the new wage definition.

- Several IT and logistics companies faced scrutiny for delayed remittance of ESI contributions, leading to penalties exceeding ₹50 lakh.

- Startups employing gig workers without registering them under the Social Security Code faced compliance audits from the Ministry of Labour.

The penalties for non-compliance are steep: fines ranging from ₹50,000 to ₹5,00,000, imprisonment for willful defaulters, and potential blacklisting from government tenders.

For foreign companies hiring in India, the reputational and operational damage from non-compliance can be even more severe, affecting their ability to attract talent or raise investment.

Future Outlook: Simplification and Tech-Driven Compliance

As India continues its digital transformation, the government aims to streamline statutory compliance for employers through integrated e-governance platforms.

1. Centralized Digital Portals

The anticipated rollout of a Unified Labour Compliance Portal in 2025 will allow consolidated filings for PF, ESI, and professional tax. This move is expected to significantly ease multi-state compliance in India, reducing redundant paperwork.

2. Automation and AI-Based Compliance Monitoring

Leading enterprises are already adopting compliance automation software to manage attendance, payroll, and document submissions. These systems automatically track labour law updates 2025, ensuring no deadline is missed.

3. Rise of EOR/PEO Models

Many organizations, especially global startups and SMEs, are turning to EOR services (Employer of Record) to handle complex payroll and labour compliance obligations. An EOR company acts as the legal employer on behalf of foreign entities, managing employee contracts, benefits, and tax filings in full compliance with Indian law.

This model allows companies to hire talent in India without establishing a legal entity significantly reducing compliance risk and administrative burden.

4. Virtual HR and Fractional Compliance Leadership

The concept of virtual HR leadership and outsourced compliance consulting is gaining traction among mid-sized enterprises. These models offer access to top compliance experts without the overhead of full-time hires, enabling businesses to remain agile yet compliant.

Conclusion

In 2025, compliance in India is not a box-ticking exercise, it is a strategic imperative. The increasing integration of technology, evolving labour law updates 2025, and growing accountability standards mean that even minor lapses can have severe financial and reputational consequences.

For global and domestic employers alike, achieving seamless Hiring compliance India requires a proactive, data-driven approach supported by trusted partners.

Businesses expanding into India should consider collaborating with specialized compliance consultants or leveraging EOR services for integrated legal and financial management. Doing so ensures that growth ambitions align with responsible governance setting the stage for sustainable success in one of the world’s most dynamic labour markets.

FAQ’s

The main challenges include adapting to new labour law updates 2025, managing complex employee taxation India 2025, and ensuring statutory compliance for employers across multiple states, especially for foreign companies hiring in India.

Foreign companies hiring in India must register under relevant employment and tax laws, adhere to FEMA and RBI guidelines, and often rely on EOR services to manage payroll, contracts, and legal obligations efficiently.

The 2025 reforms implement key provisions from the new labour codes on wages, social security, and industrial relations. Employers must comply with unified wage definitions, digital filings, and expanded social security coverage for gig workers.

Multi-state compliance India refers to managing different state-level labour laws, minimum wage rules, and Shops & Establishments Acts. Each state has unique requirements, making uniform compliance for pan-India operations complex.

Non-compliance can lead to fines up to ₹5,00,000, imprisonment, and reputational damage. The government’s 2025 digital compliance monitoring systems have increased enforcement for PF, ESI, and wage misclassification violations.

EOR services (Employer of Record) manage end-to-end employment including contracts, payroll, taxes, and benefits ensuring statutory compliance for employers while allowing businesses to hire talent without setting up an Indian entity.